Since its SEC approval in January 2024, BlackRock’s Bitcoin spot ETF, IBIT, has recorded positive net volumes for 70 consecutive days. This consistent performance testifies to investors’ stability and confidence in the world’s 1 asset manager’s ETF.

Another record for BlackRock and its Bitcoin spot ETF

Since the Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs in January 2024, one in particular has stood out: BlackRock’s IBIT.

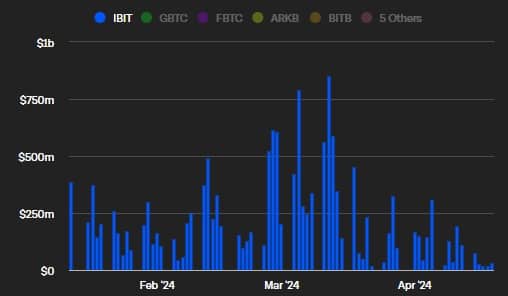

This ETF captured the attention of many investors, gathering over $17 billion in net volumes, equivalent to over 270,000 BTC.

BlackRock IBIT net volumes since approval

The most remarkable thing about this ETF is that it has recorded positive net volumes every day since its launch, covering exactly 70 trading days. To date, IBIT has not experienced a single day of negative volumes.

Prior to IBIT, only 10 ETFs had recorded better or equivalent performance. Among them, Global Jets JETS, which provides access to a diversified basket of airline stocks, had also achieved 70 consecutive days of positive net volumes.

Topping the list was Pacer’s US Cash Cows 100 ETF (COWZ), an index composed of large-cap US equities, with 104 consecutive days, followed by Vanguard’s Total International Bond ETF, which offers diversified exposure to international bonds, with 105 days, and J.P. Morgan Efficient Economy (JEPI) with 160 days, an ETF designed to track the performance of US equities while reducing volatility.

Another notable performance is that of Fidelity’s Bitcoin spot ETF, FBTC, which, since its launch, has had no net outgoing volume days, although it has recorded several days with zero volumes.

BlackRock confirms its leadership

Despite this performance, BlackRock’s IBIT still doesn’t hold 1st place in terms of assets under management among Bitcoin ETFs.

Indeed, the GBTC, which has been operating for several years as a Bitcoin Trust, holds nearly 305,000 Bitcoins, or almost $19 billion. However, IBIT could soon overtake GBTC in terms of assets under management, given current trends.

Since its conversion to a spot ETF, the GBTC has steadily lost Bitcoins under management, with 70 consecutive days of net outflow volumes, in contrast to the IBIT, which is recording net inflows.

BlackRock is also looking to make its mark on the Ether market by applying for a spot ETF on the 2nd most capitalized cryptocurrency. Should these spot Ethereum ETFs be approved, BlackRock could quickly take a significant share of the ETH market.