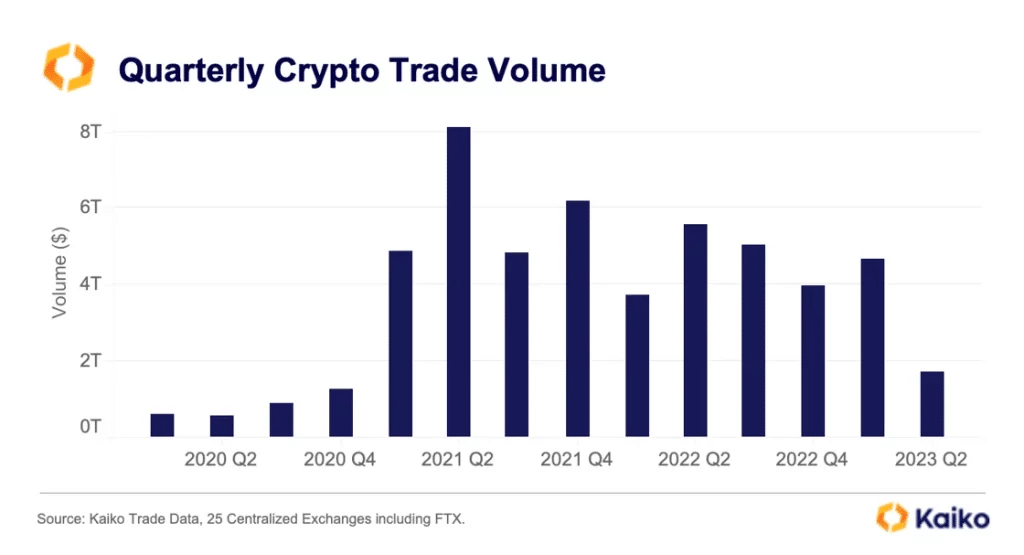

Trading volumes have not been this low for over two years. In the last quarter alone, trading volumes on centralised exchanges fell by a factor of 2.5. Although significant, this fall in volumes does not affect all cryptocurrencies equally: altcoins are the biggest victims of this bear market.

Falling trading volumes

Despite Bitcoin’s (BTC) recent rise to the $30,000 mark, the cryptocurrency industry is facing a major challenge: how to rekindle the flame of trading volumes?

In one of its latest reports, the company Kaiko unveiled data on trading volumes in the cryptocurrency market. As a reminder, trading volume represents the total amount of trading that has taken place on a given security.

According to the company specialising in data analysis, trading volume over a quarter is at its lowest since autumn 2020. Note that this chart is based solely on data from 25 centralised exchanges, including Binance, Coinbase, Kraken and OKX, to name but a few.

Quarterly trading volume on cryptocurrency exchanges

With a volume of around $1.75 trillion per quarter, the cryptocurrency sector is far from having lost all its investors. However, the fall in these figures in previous quarters testifies to the sector’s declining financial activity.

Indeed, trading volume has fallen by a factor of 4 since peaking at $8 trillion during the 2021 bull market. Similarly, between the first and second quarters of this year, trading volumes plunged by 250%.

Volumes are regularly used in technical analysis, one of their main functions being to identify moments of euphoria and calm in a given asset.

In addition, these data show that the arrival of the bear market has caused a number of investors to flee the market, while at the same time reducing the number of financial transactions on centralised exchanges.

Altcoins on the sidelines

To get a more accurate look at the situation in the cryptocurrency market, an analysis separating the two largest assets in the sector (BTC and ETH) and altcoins needs to be carried out.

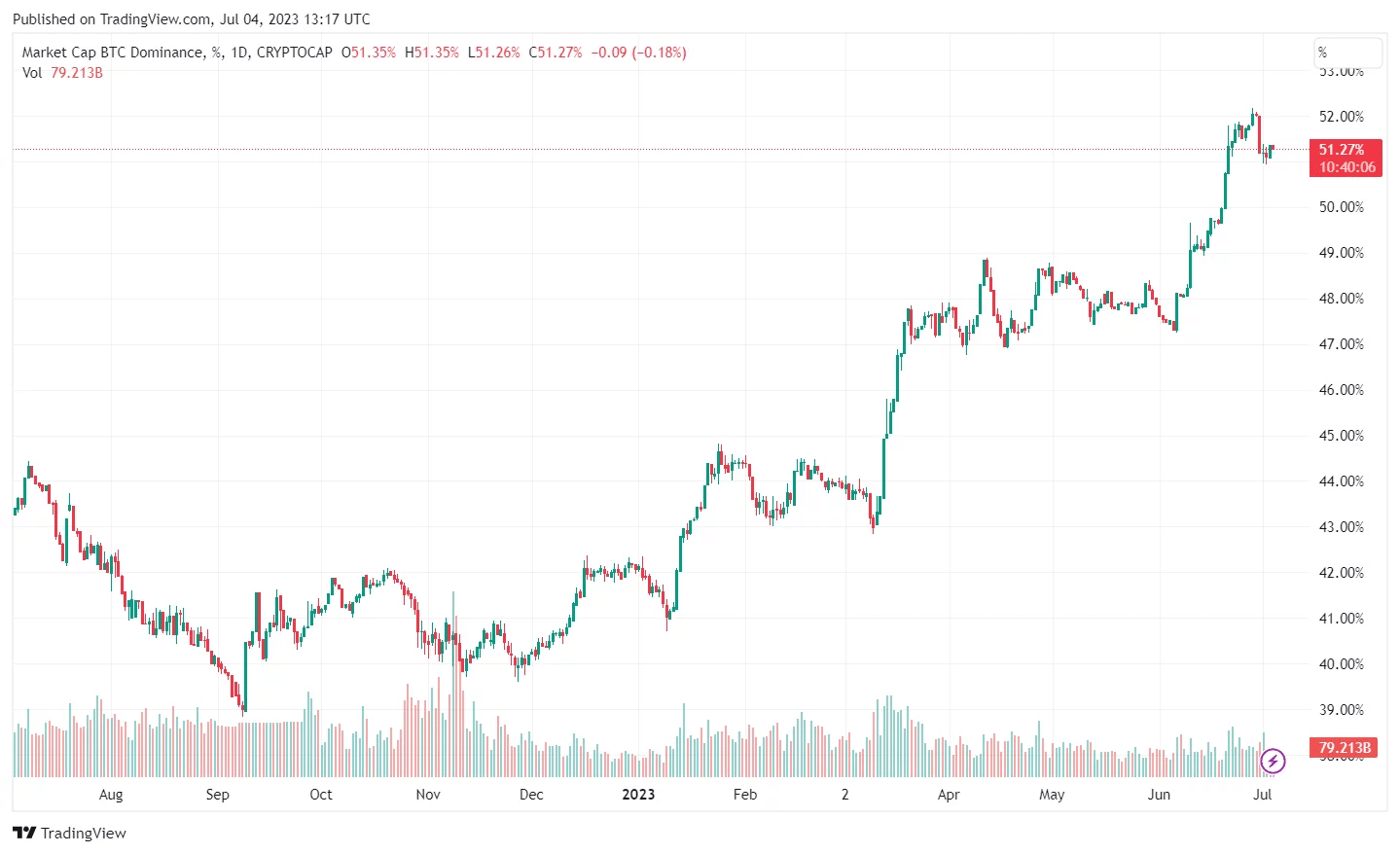

At the time of writing, investor interest is focused on the two stocks with the largest market capitalisations, namely Bitcoin and Ether. Over the past year, their dominance of the cryptocurrency market has increased significantly: ETH’s share has risen from 15% to 20%, while BTC’s share has risen by a further 8% to 51%.

Bitcoin’s dominance of the cryptocurrency market over the past year

On the cryptocurrency market, dominance is a tool offering an overview of which assets are trusted by investors. The rise in dominance of the world’s two largest cryptocurrencies shows that investors are pulling out of altcoins and moving to assets considered more reliable.

As for the other cryptocurrencies, with the exception of a few narratives and other outsiders, the majority have not benefited from the successive rises in Bitcoin and Ether.

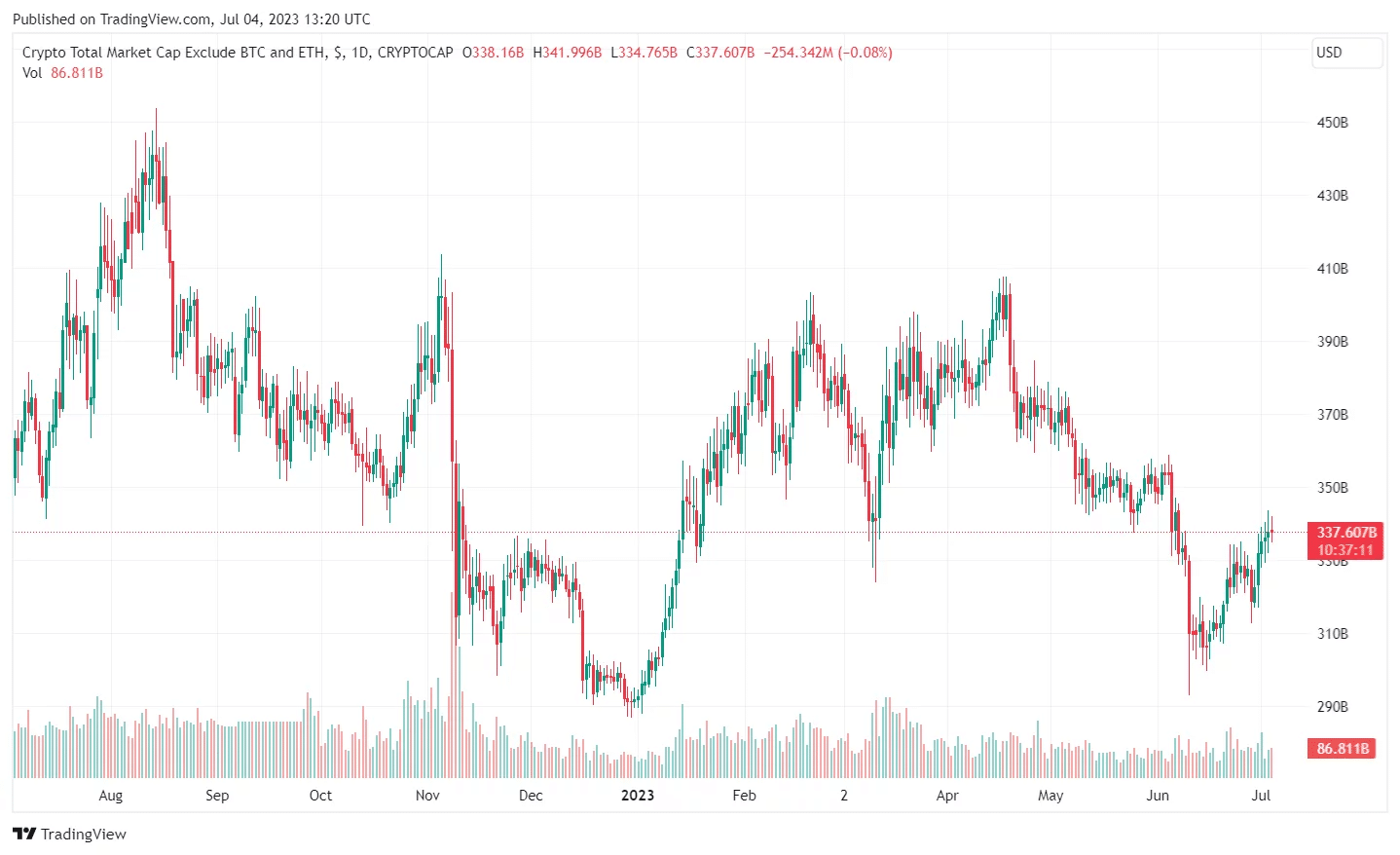

While the latter have managed to make up for their losses following the fall of FTX, altcoins remain in a downtrend, a situation aggravated by recent SEC rhetoric regarding some of these assets as financial securities.

Change in cryptocurrency market capitalisation over one year, excluding ETH and BTC

Over the past 12 months, Bitcoin has risen by 57%, while Ether has grown by 76%. Altcoins, on the other hand, are struggling to recover: after one year, their total capitalisation has fallen by 5%.

As a result, interest in cryptocurrencies is uneven between the different assets: during the current bear market, altcoins, considered to be the riskiest stocks on the market, are being shunned in favour of BTC and ETH.