Since its beta launch in August, Friend.tech has recorded an impressive trading volume, exceeding $8.1 million on its first day alone. What is Friend.tech, what is its model and what can we expect from it, now that the data of more than 100,000 users has been leaked?

What is Friend.tech?

Last week, the friend.tech application was in the news on social networks, often highlighted by influencers, content creators or well-known figures from the crypto ecosystem on X (formerly Twitter).

So what is friend.tech? Built on Base, the layer 2 developed by Coinbase, which recently rolled out its mainnet, friend.tech is a Web3 social application linked to X that allows its users to sell fractions of shares representing their profile. In other words, someone who joins friend.tech can buy a share representing part of another user’s profile.

This model therefore enables the personalities in the ecosystem to generate revenue by selling fractions of their friend.tech profile to their future shareholders. In exchange, the application allows them to communicate directly with the person from whom they have purchased a share via private chat rooms and to access exclusive content. For its part, friend.tech charges a 5% fee on all transactions carried out on the application.

The application seems to be catching on: launched in beta on 10 August, friend.tech has already recorded a trading volume of over 8.1 million dollars on its first day alone. This momentum is being driven not only by well-known personalities, who want to attract new shareholders by promising them rewards (such as revenue-sharing through the platform), but also by the airdrop announced by friend.tech, which will be based on beta activity over the next 6 months.

For your information, the unit price for a share has sometimes exceeded 3 ETH (more than 5,000 dollars) for the most popular profiles on the social network.

The nuances of supply and demand

friend.tech has designed its model so that the early purchase of a share can translate into substantial profits when it is resold. The more shareholders there are in a profile, the higher the cost of the shares associated with that profile, according to the fundamental principle of supply and demand.

However, this growth is exponential: shares valued at around ETH 3 (the most expensive) are held by fewer than 200 individuals. This implies a rapid increase in the value of shares, but it also considerably reduces their availability. In other words, with its current model, friend.tech encourages the formation of small communities, accessible at a high cost, unless you were among the first to invest in a share.

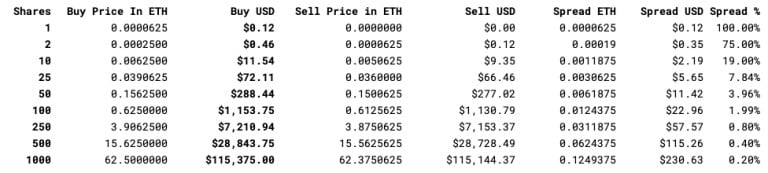

Share price evolution, via @MentionLux

Given the high volatility resulting from the small number of holders, we can emphasise that the speculative bubble of a friend.tech share is much larger than for assets in the classic crypto ecosystem.

So, although the application is still in its infancy, we could imagine controversy being created quite artificially to encourage the sale of shares in certain personalities. It should also be noted that the creators could dump money on the backs of their shareholders, although this would be risky for them insofar as it would be directly visible.

Finally, various people have reported that they were able to extract wallet addresses from the friend.tech database, along with the Twitter account linked to each of them. This calls into question the reliability of the application’s code, as well as paving the way for all kinds of scams and dust attacks. More than 100,000 accounts are already at risk, according to Banteg.

At the same time, friend.tech currently offers no privacy policy for its services, which is a rather troubling point.

On the positive side, however, friend.tech’s structure means that the personalities in question have to maintain a sufficiently high level of quality to retain a large number of shareholders and encourage share trading, as their income is entirely dependent on this.

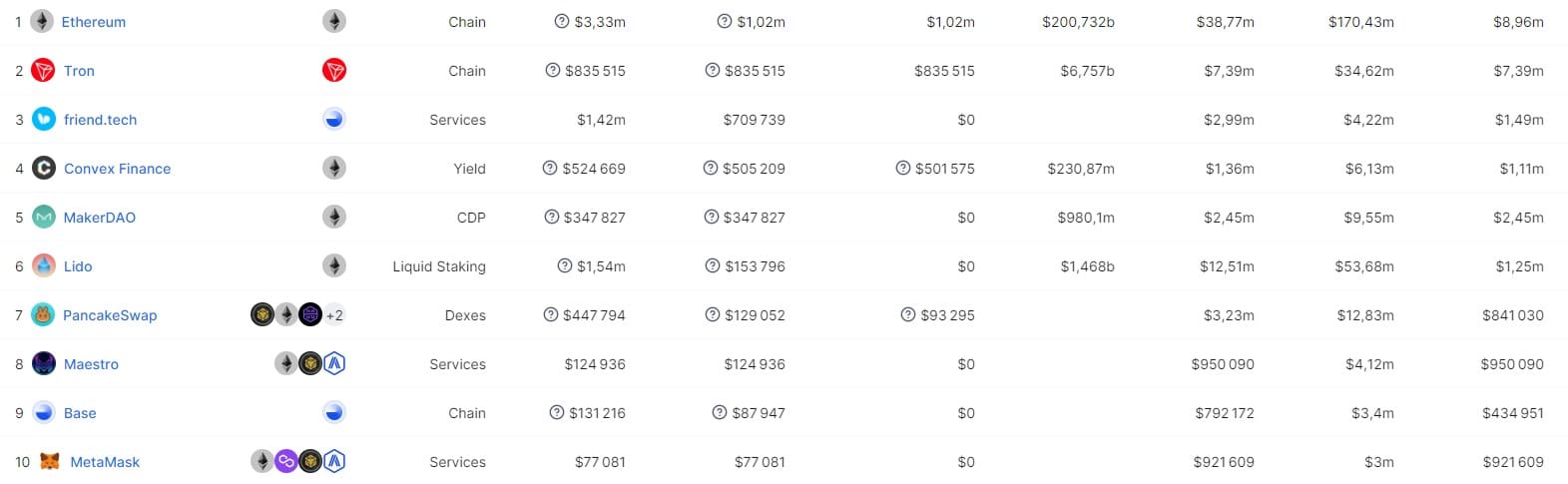

Be that as it may, friend.tech seems to have found its audience for the time being: with around $710,000 generated over the last 24 hours, the Web3 application has overtaken such behemoths as Lido, MakerDAO and Convex. In terms of fees over the same period, friend.tech has overtaken Tron (TRX) and even DEX Uniswap (UNI).

Ranking of blockchain services by revenue over 24 hours

According to Dune data compiled by @cryptokoryo, friend.tech currently has 70,500 unique buyers and 27,810 unique sellers in over 1.1 million transactions. In total, more than $27.9 million has been used to buy shares on the platform.

However, according to most of its current users, friend.tech is currently limited to the principle of buying and reselling, with a very limited interface and very few features apart from private messaging.