What about Goldman Sachs? The financial institution has gradually revised its copy about cryptomurrencies. To the point of envisaging a Bitcoin (BTC) at $100,000 in the next five years.

Goldman Sachs thinks Bitcoin will reach $100,000

As Bloomberg reports, analyst Zach Pandl made this optimistic forecast in a note to investors shared yesterday. According to Goldman Sachs, the evolution of Bitcoin’s (BTC) capitalisation could see it pass the $100,000 mark within five years.

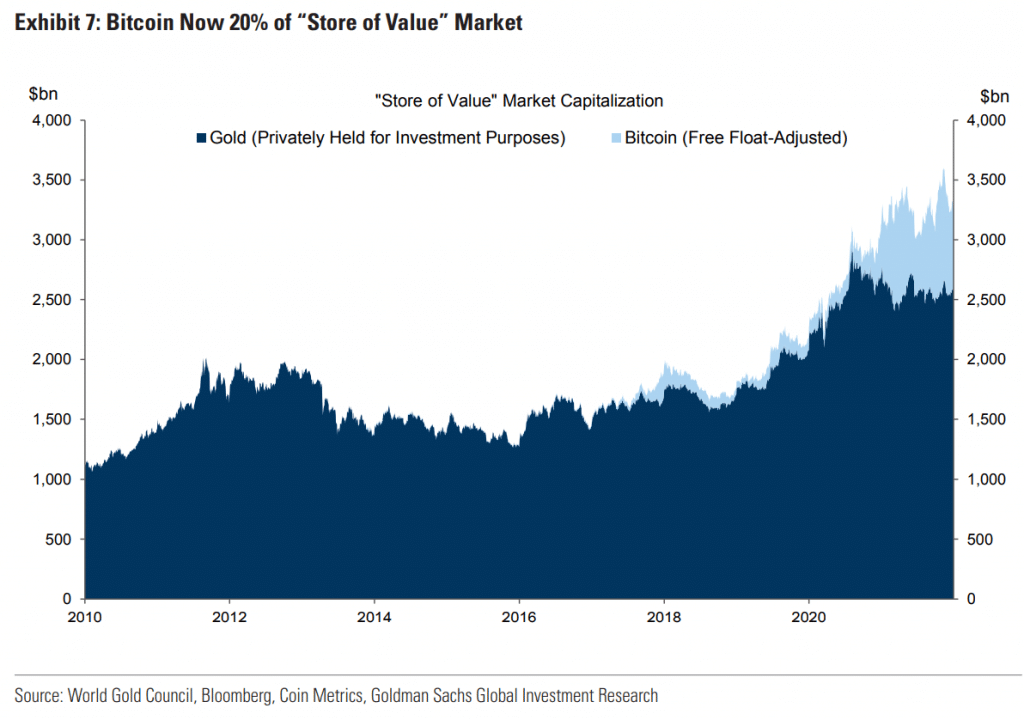

The institution estimates that the adjusted capitalisation of Bitcoin is around $700 billion. This would correspond to 20% of the capitalisation of the “store of value” asset market. This market consists of Bitcoin and gold, according to Goldman Sachs.

For comparison, the capitalisation of gold is estimated at around $11,553 billion. At its peak, BTC reached a market cap of $1,291 billion at its previous record price last November.

The “store of value” market

Goldman Sachs’ hypothesis is that if this share of the store-of-value market were to rise to 50% for Bitcoin, its price would then exceed $100,000:

Market for stores of value (Source: Goldman Sachs via Bloomberg)

Anyway, this confirms once again that Bitcoin is now firmly established in its role as “digital gold”. That said, one can’t help but notice a bit of a shift on the part of Goldman Sachs. In June, another analyst considered BTC to be comparable to copper, rather than gold. But since then, it has hit an all-time high, and it seems that the institution has changed its mind…