The International Monetary Fund (IMF) has updated its forecasts for global inflation and growth. What does the IMF predict, and will the economic situation of individuals improve?

The IMF’s 2023 inflation forecast

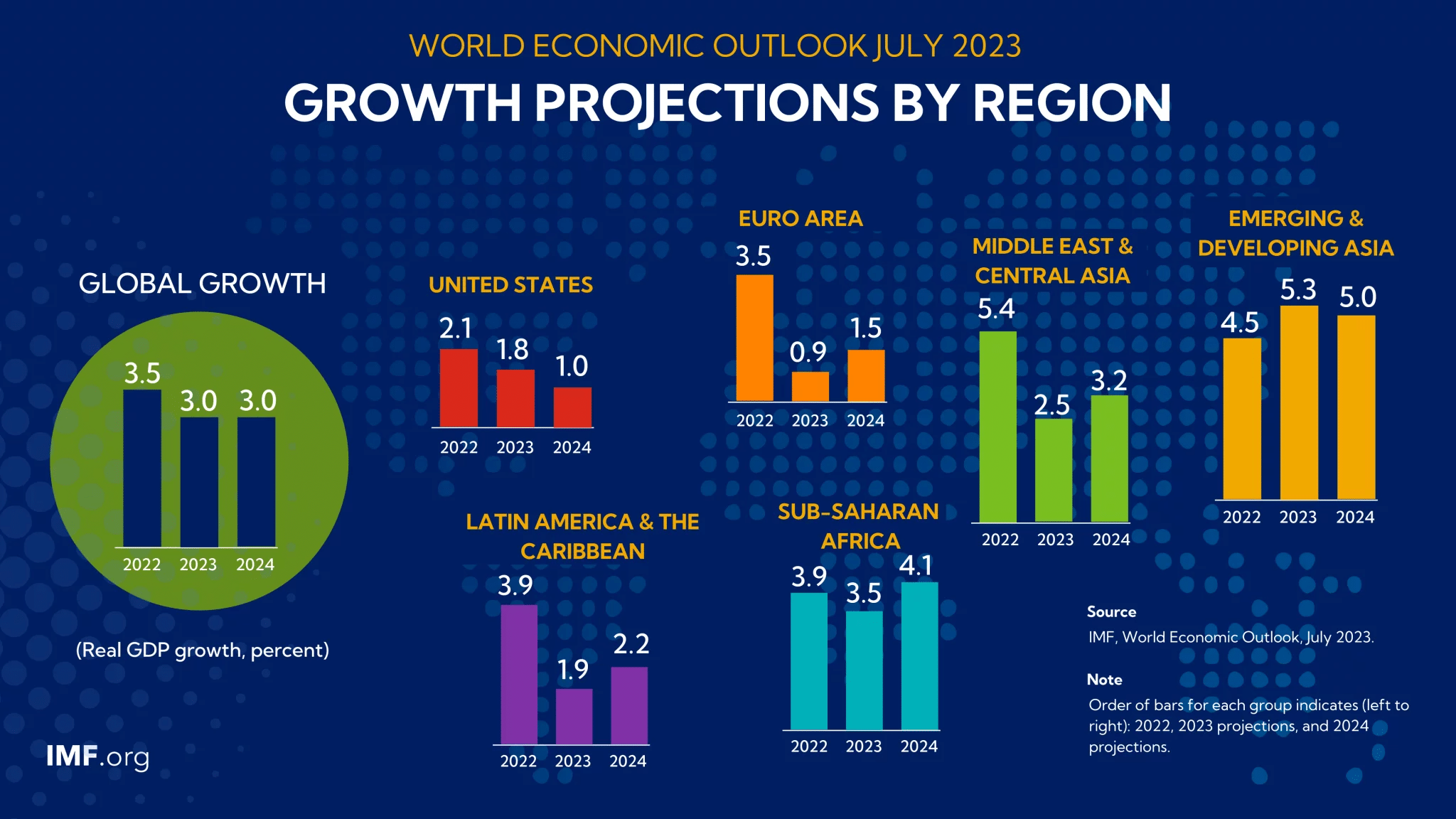

The IMF has published an update of its growth forecasts. The good news is that these are more optimistic than the last ones. The institution is forecasting growth of 3% for the current year, slightly higher than last April’s forecast of 2.8%.

The bad news, however, is that inflation will continue to fall at a comparatively slow pace. Here too, however, there is a degree of optimism: while last April the IMF forecast inflation at 7.2% for 2023, it has now revised its forecast to 6.8%. For 2024, the IMF anticipates a sharper fall: inflation could be as low as 5.2%.

The report, however, tempers this optimism, pointing to a global situation that still gives cause for concern:

“Although the forecasts for 2023 are slightly more favorable than predicted in April 2023, they remain weak compared with historical precedents. “

War in Ukraine, climate disruption and post-Covid

The IMF’s caution is justified by the unpredictable evolution of the war in Ukraine, as well as sudden climatic events, such as the forest fires currently being observed. In addition, the report notes that the post-Covid recovery has been held back by other geopolitical elements.

” The balance of risks to global growth tends to remain pessimistic. Inflation could remain high, or even rise if new crises arise, including those linked to an intensification of the war in Ukraine, as well as extreme weather events, which would trigger more restrictive monetary policies. “

The United States would suffer the most from this slowdown. For Europe, the outlook for 2023 is equally pessimistic:

Growth trends by world region

However, optimism is to be found on the wage front, again according to the IMF. Analyst Pierre-Olivier Gourinchas believes that corporate profits will allow for significant wage increases, without fuelling inflation:

“If the labor market remains strong, we should expect wages to recover. […] Average corporate profits have grown robustly over the past two years. I therefore expect that there will be room for wages to grow.”