A proposal to MakerDAO recommends allocating up to 1 billion DAI as collateral for Ethena’s USDe. If approved, this initiative could significantly enhance the stability and liquidity of USDe.

What if the DAI collateralized Ethena’s USDe?

The BA Labs team, a member of Maker DAO’s Stability Scope Advisory Council, recently proposed allocating between 600 million and 1 billion DAIs to collateralize Ethena’s synthetic USDe.

MakerDAO is a decentralized finance (DeFi) protocol that enables the creation of DAI, a stablecoin backed by the dollar. The protocol maintains the DAI’s parity with the dollar through an over-collateralization mechanism. In other words, to issue a DAI, the user must lock in a quantity of cryptocurrencies equivalent to 150% of the value of the DAI he is borrowing.

Ethena, meanwhile, is a DeFi protocol that enables the creation of USDe, another dollar-backed stablecoin. This protocol maintains USDe’s parity with the dollar by opening short positions against the assets held by the protocol.

Allocating 600 million DAI to USDe collateral would increase its capitalization and make it more liquid, thereby reducing the risk of losing parity with the dollar, meeting the growing demand for USDe, and enabling Maker DAO to increase the income from its insurance fund thanks to the returns offered by Ethena.

To sum up, if MakerDAO were to allocate 600 million DAI as collateral for USDe, the Ethena protocol would open short positions equivalent in value to 600 million dollars against DAI.

This mechanism guarantees the stability of the USDe’s value, as any potential depreciation of the DAI against the dollar would be offset by the profits generated by the short position.

Ethena’s strategy for maintaining USDe parity with the dollar differs markedly from those adopted by most stablecoins on the market, which rely on a reserve of dollars held by banking institutions.

Moreover, the mechanism used by USDe is similar to that of stablecoins, introduced by Galoy over a year ago, i.e. a synthetic asset based on a short position against Bitcoin. This approach is also adopted by 10101’s USD-P, another Bitcoin-based synthetic asset that uses Discreet Log Contracts (DLC) to enable short positions to be opened without relying on intermediaries.

USDT still dominates the stablecoin market

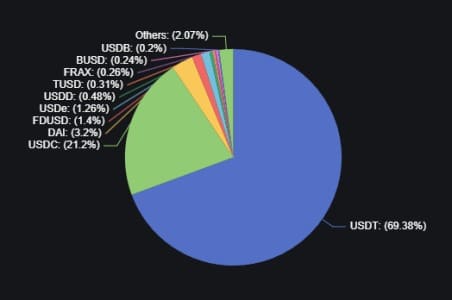

According to DefiLlama data, the stablecoin market has a total capitalization of $150 billion. Tether dominates this market with its USDT, posting a capitalization of $105 billion, or almost 70% of the total.

It is well ahead of the 21% market share of Circle’s USDC, with a capitalization of $32 billion, and the 3.2% of MakerDAO’s DAI, which reaches $4.9 billion.

Stablecoin market dominance

Exclusively available on Ethereum, USDe, launched in February 2024, already occupies 5th place in the stablecoin ranking by capitalization, with nearly $2 billion.

If MakerDAO were to approve the proposal to allocate 600 million IADs in the Ethena protocol, USDe’s capitalization would rise by 30%, enabling it to move up one place in the ranking, surpassing FDUSD.