The number of ethers (ETH) stored on exchange platforms has reached its lowest level of the year. Why is this a rather “bullish” sign for the Ethereum cryptocurrency?

How much of ETH is stored on exchanges?

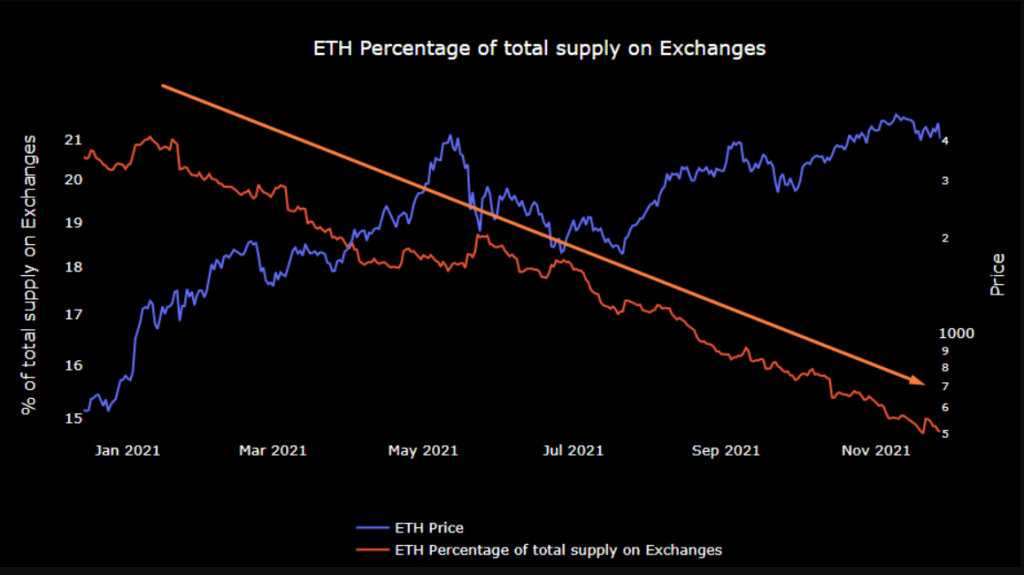

An analyst at CryptoQuant reported on the rise of this indicator in a publication earlier this week. He says that the drop in the number of ETH on exchanges has been particularly rapid. Only 14% of the ETH supply is in fact stored on exchanges, a drop of 7% over the last eleven months.

As can be seen in the following chart, the gradual decline in the number of ETH on exchanges has accompanied a rise in the price of Ether throughout the year

Percentage of ETH supply on exchanges (Source: CryptoQuant)

The link between exchange platforms and the price

Within the crypto ecosystem, it is commonly accepted that when crypto currencies flood onto exchange platforms, it is an indication that their holders want to be able to sell quickly. It is therefore widely seen as a sign that the price may fall.

Conversely, when few crypto-currencies are present on exchanges – such as ETH here – it is seen as a positive sign. It may indicate that holders have stored their crypto-currencies in “cooler” wallets, and therefore do not intend to sell soon.

At least that is the interpretation of the CryptoQuant analyst in the medium term. He explains:

I would say that [this drop in ETH on exchanges] is not yet fully reflected in the price. Because the price is almost at the same level as in May 2021. The price has flattened/decreased, while the percentage on the exchanges has shrunk significantly. This can’t go on forever.

ETH price is rising this week

So could the ETH price soon reflect this investor confidence? This is particularly likely this week, as the second cryptocurrency is rising more than Bitcoin (BTC).

The BTC price seems to have been stopped short by the latest statement from US Federal Reserve Chairman Jerome Powell, who warned yesterday of prolonged inflation. But ETH seems to be faring better.

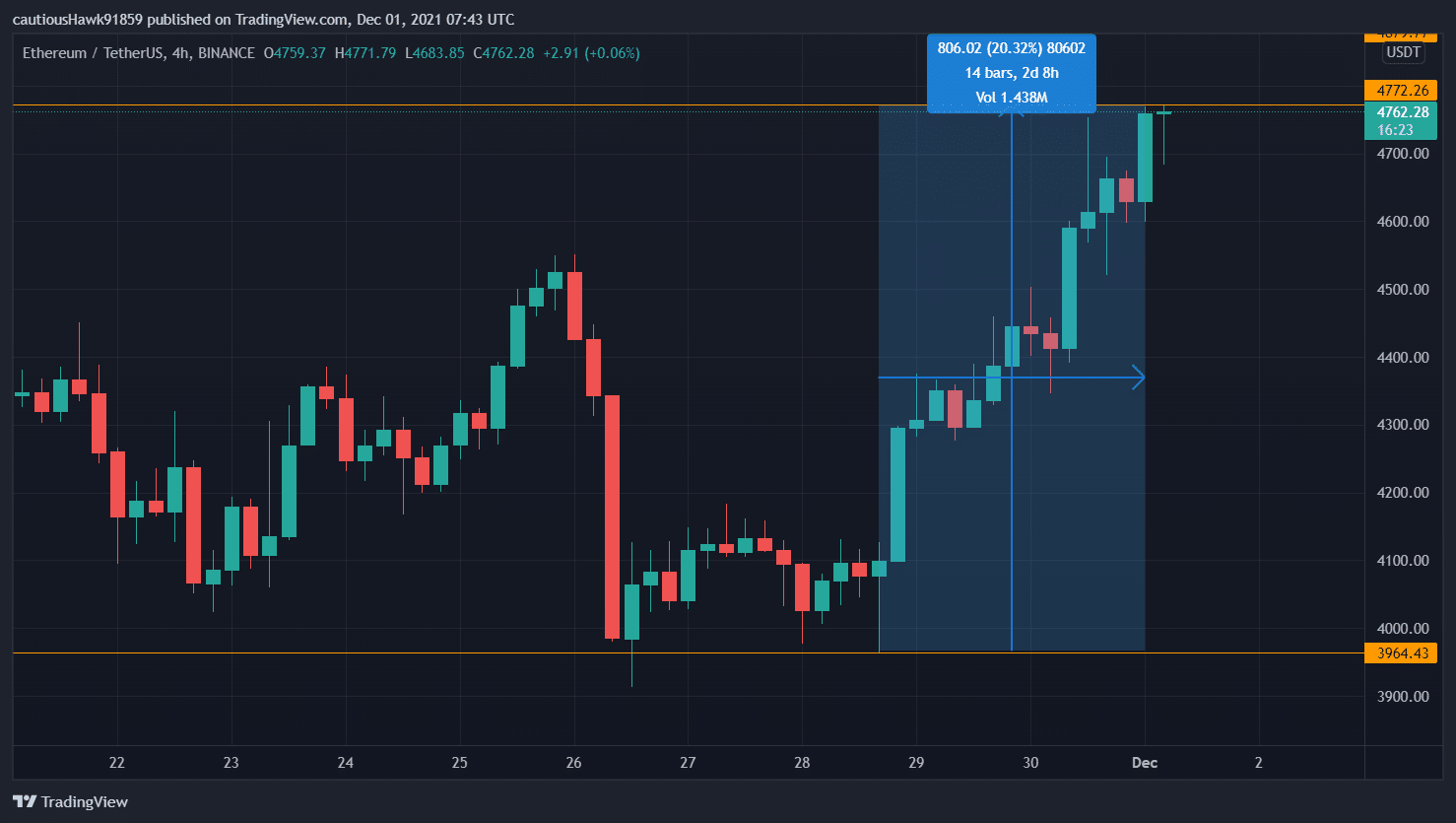

While the largest cryptocurrency is posting a meagre +0.3% over the last 24 hours, Ether is up +7% since yesterday. In just over two days, it has even jumped +20%

ETH price progression over the week (Source: TradingView, ETH/USDT)

ETH now seems to have an easier time disassociating itself from the trends affecting BTC. This morning it is trading at $4,752, with a capitalization of $561 billion. This brings its dominance to 20% of the total cryptocurrency market cap, compared to 38% for BTC.