While the cryptocurrency market is going through a period of uncertainty, stablecoins, those cryptocurrencies indexed to stable currencies such as the US dollar or the euro, continue to gain popularity with investors. But the great leader of this market section, Tether’s USDT, is losing ground.

The stablecoin market is still growing strongly

Marked by the fall in the Bitcoin (BTC) price, the cryptocurrency market is in a consolidation phase, but certain assets continue to attract users: stablecoins. These cryptos, indexed to stable assets such as the US dollar, offer an alternative to traditional fiat currencies on crypto exchange platforms.

Currently, stablecoins backed by the US dollar and the euro account for the majority of crypto transactions, capturing 82% of total volume compared with just 18% for traditional fiat currencies.

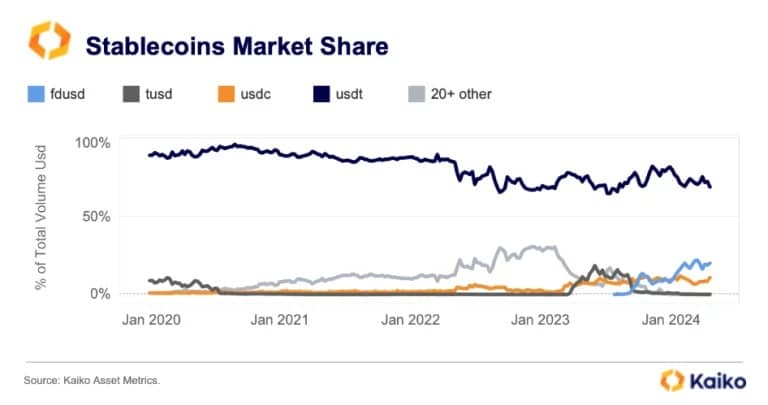

Within this fast-growing market, the dominance of Tether (USDT), the No. 1 stablecoin in terms of market capitalization, seems to be eroding by the day.

According to a study by Kaiko Research, USDT’s market share on centralized exchanges (CEX) is declining considerably. Indeed, it has fallen from 82% to 69% since the beginning of the year.

Ranking of stablecoins by trading volume

Despite this, Tether remains the undisputed leader in terms of cumulative trading volume (over $3.6 trillion traded in 2024 alone), well ahead of its closest competitors such as Circle’s USDC or First Digital’s FDUSD.

Stablecoins: the arrival of new players disrupts Tether’s dominance

Competition is intensifying with the arrival of new players like FDUSD, who are taking advantage of some platforms’ attractive policies, such as the no-fee trading periods sometimes offered by Binance.

There is also a growing preference for regulated stablecoins, such as the USDC in the United States. USDC is the only one of the top 5 stablecoins by market capitalization to benefit from a US regulatory framework for money transfers.

USDC’s market share has grown from 1% in 2020 to 11% today, demonstrating users’ growing interest in security and transparency.

Market shares of the main stablecoins on the crypto market

The emergence of innovative solutions such as Ethena’s USDe, a stablecoin offering yield, could also weaken Tether. Launched last February, USDe has seen its trading volume explode, surpassing that of USDC over that period.

However, while these new algorithmic stablecoins offer advantages in terms of returns, they also raise questions on the regulatory and security fronts.

The possible tightening of U.S. regulations on stablecoins, enacted by a bill currently under discussion, could in particular slow down their adoption by the general public.